STATEMENT.LD 2009-2026 free printable template

Show details

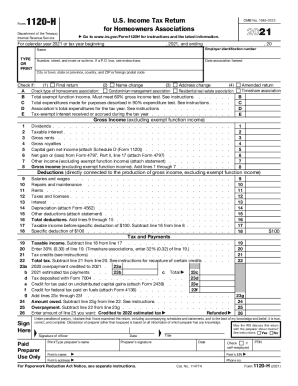

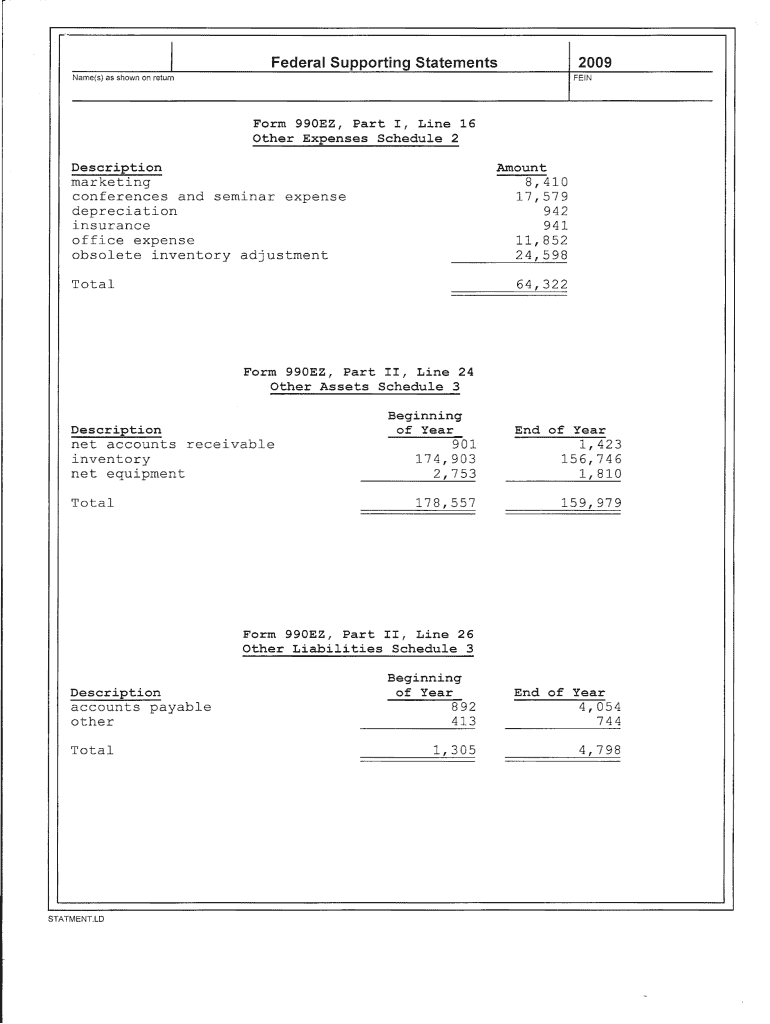

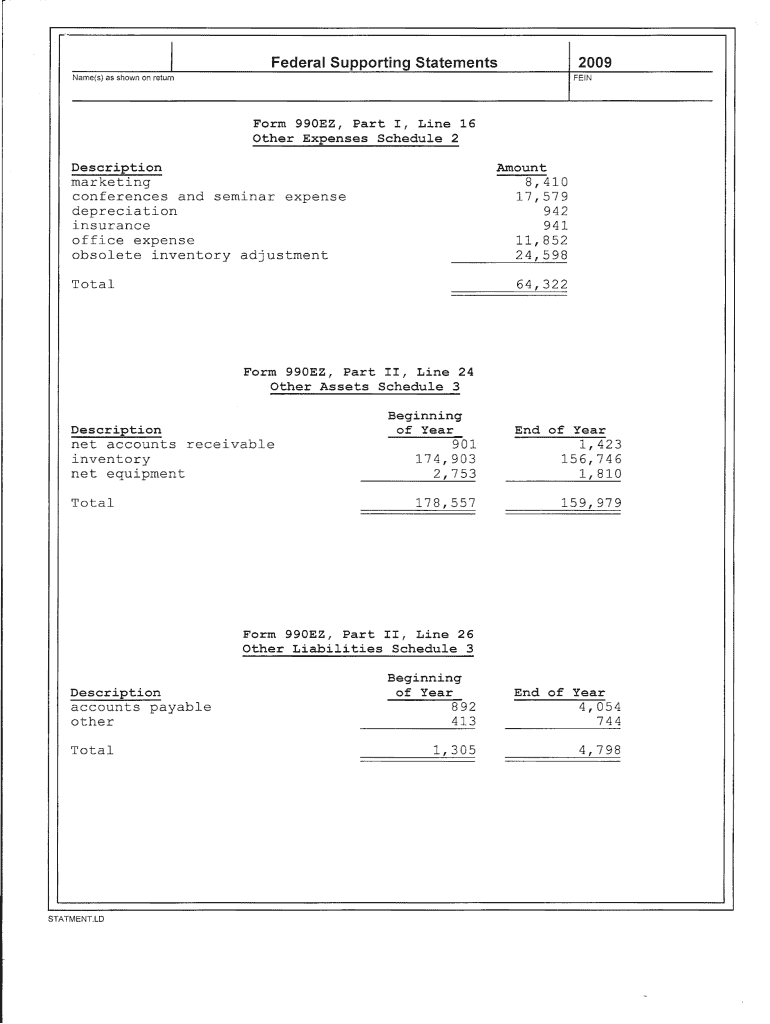

I Federal Supporting Statements Name s as shown on return FEIN Form 990EZ Part I Line 16 Other Expenses Schedule 2 Description Amount marketing conferences and seminar expense depreciation insurance office expense obsolete inventory adjustment 17 579 11 852 24 598 Total 64 322 Other Assets Schedule 3 Beginning of Year End of Year net accounts receivable inventory net equipment 174 903 156 746 178 557 159 979 Other Liabilities Schedule 3 accounts payable other STATMENT.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign federal supporting statements form

Edit your federal supporting statements template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal supporting statements form 1120s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal statements form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit federal supporting statements form 1120. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out printable tax forms

How to fill out STATEMENT.LD

01

Start by obtaining the STATEMENT.LD form from the relevant authority or website.

02

Read the instructions provided at the top of the form carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details in the designated fields.

04

Provide any required financial information, ensuring accuracy and completeness.

05

Include specific details or explanations as requested in the form, such as dates or descriptions.

06

Review the completed form for any errors or omissions.

07

Sign and date the form at the bottom as required.

08

Submit the form via the specified method, whether by mail, online, or in person.

Who needs STATEMENT.LD?

01

Individuals applying for financial assistance or benefits.

02

Students seeking educational loans or scholarships.

03

Applicants for government grants or programs.

04

People undergoing legal procedures that require financial disclosure.

Fill

federal supporting statements pdf

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get statement template?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific statement form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in federal form statements blank without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing tax return statement example and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete statement forms on an Android device?

On Android, use the pdfFiller mobile app to finish your federal supporting blank. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is STATEMENT.LD?

STATEMENT.LD is a regulatory document required for reporting certain financial or operational data to regulatory authorities, typically mandated by specific legislation.

Who is required to file STATEMENT.LD?

Entities such as businesses, organizations, or individuals involved in activities covered by the regulations that necessitate the filing of STATEMENT.LD are required to file it.

How to fill out STATEMENT.LD?

To fill out STATEMENT.LD, gather the necessary information, complete each section as outlined in the instructions provided with the form, and ensure all data is accurate and complete before submitting.

What is the purpose of STATEMENT.LD?

The purpose of STATEMENT.LD is to ensure compliance with regulatory frameworks by providing authorities with relevant financial or operational information that aids in oversight and regulation.

What information must be reported on STATEMENT.LD?

Typically, STATEMENT.LD requires reporting of financial data, operational metrics, compliance information, and any other specific data as dictated by the relevant regulatory requirements.

Fill out your STATEMENTLD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supporting Statement Template is not the form you're looking for?Search for another form here.

Keywords relevant to federal supporting statements 2024

Related to statement forms business

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.